At what pace should the new technologies be adopted?

We invite you to meet Marta, find out about her first day with her new digital bank, and view the video-report Banking's new value creation model based on disruptive technologies

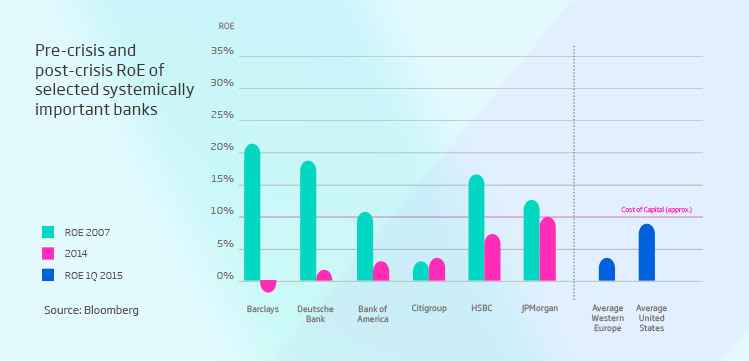

In the wake of the financial crisis, the banking sector, especially retail banking, is in a tricky situation. In 2015, the average RoE for retail banking was around 5%, in contrast to the stance taken by shareholders, who continue demanding that their investments have a return of at least 10% (Cost of Capital). If this situation continues, it could destroy the structural value at banks and jeopardize their survival.

What are the challenges currently facing the banking system following the financial crisis?

Will Fintech companies do away with traditional banking and provide the solution to every problem?

What role do deposits via “payments” play in the profitability of the banking sector of the future?

What is the way to recover an appropriate profitability on the Cost of Capital?

We will answer these and many other questions that can help us to understand the complex situation that banking is facing. Mainly, though, we will present and propose some of the solutions that must be implemented to reinvent a new banking business model, which is more efficient and more in line with stakeholder interests.

These new solutions, which come out of a strong support for disruptive technology-based innovation, give the possibility of forming a new digital relationship with the client, optimizing costs, differentiating products and, in short, consolidating a business model with a sustainable capacity to create value.

At what pace should the new technologies be adopted?

We invite you to meet Marta, find out about her first day with her new digital bank, and view the video-report Banking's new value creation model based on disruptive technologies